Introduction ![]()

This is an example of a trade taken in EvE® Online with criteria and software covered by the Price Action Trading Course published on this web site.

Both the various software setup and market analysis may look daunting at first. The effort is indeed required but only the first times. After that, the whole chain of procedures takes about 5 minutes, the market analysis takes 15-20 minutes. This is less time intensive than analyzing an EvE® trading route or finding out which items are to sell and which to reprocess.

This article will not cover all the details involved in the trading decisions. For a very long and detailed process explanation please refer to this other example.

~1~

Prices history has been exported from EvE Marketeer by following the procedure shown on this web site, at this location.

The resulting OHLC text file has subsequently been imported in the MultiCharts® Discretionary Trader charting software, by following the procedure shown on this web site, at this location.

Why the trade happened and market analysis

This specific trade has been made because of three factors. The first is the series of minerals faucets nerfs announced for the Escalation to Inferno patch. The second is the concomitant EvE® Online “special event”, Hulkageddon, organized by a player called Helicity Boson.

Hulkageddon causes ships destructions and minerals / ice isotopes shortage. This a nice earning opportunity for a series of players: industrial ships builders, suicide gank boats manufacturers, modules builders, miners and traders / speculators.

The third factor is about the very nature of EvE® Online: minerals are all closely tied. All the ships and items tend to have similar proportions of the different minerals. What most players don’t know is that what once used to be an insurance forcibly imposed minerals basket has become a blueprint biased mineral basket. Therefore we still have a tie effect, even if it’s a diluted effect compared to the former insurance enforced mineral basket. The result of this effect is: when Tritanium becomes much more expensive due to the factors above, then the demand for the other minerals plummets and their prices sharply drop.

The trade

Since about April 9, 2012 I have been discussing about Tritanium on the EvE® Online forums.

In particular, these were the graphs I analyzed and posted:

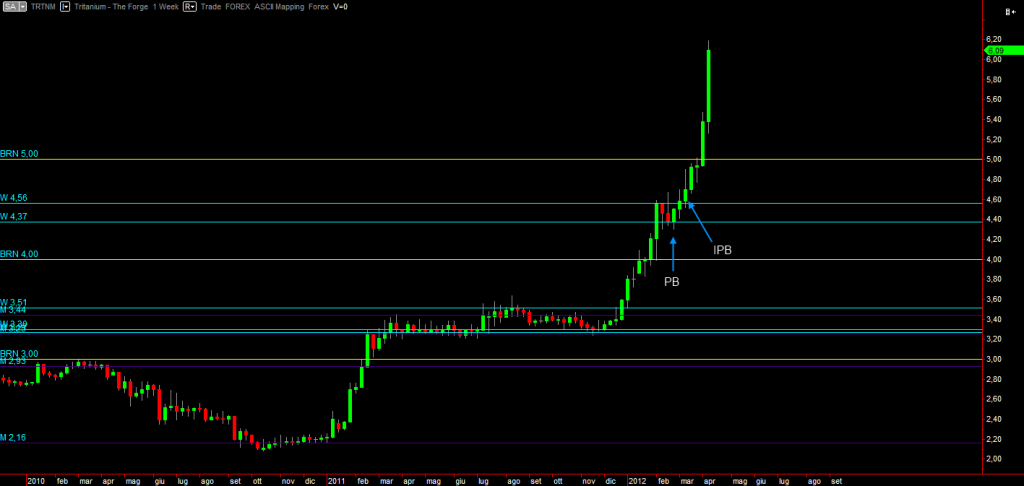

Weekly:

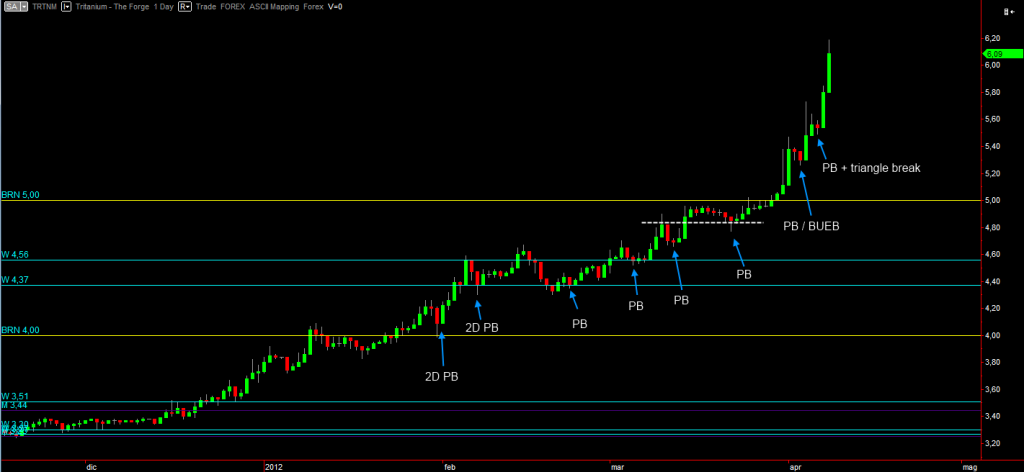

Daily:

I had enough liquidity to buy Tritanium at the last March pin bar (PB), the one with the dotted line acting as support (acted as resistance for the range market (RM) right before its swing).