Bid – ask spread: buyers want to buy at the lowest possible price, sellers want to sell at the highest possible price. At the same time, some buyers and sellers either are happy with the price asked by a close counterpart or just give up achieving their goal or have a pressuring need to buy / sell that stock or are just scared by bad news. The exchange (usually through brokers) checks thousands of market orders every second and sees if some of them match. If they do, then a trade happens, and overall stock price rises or drops a bit in the direction of the trade. The exchange may show a so called “orders book” or “market depth view” (in EvE it’s the markets order window) listing a predefined number of the closest orders.

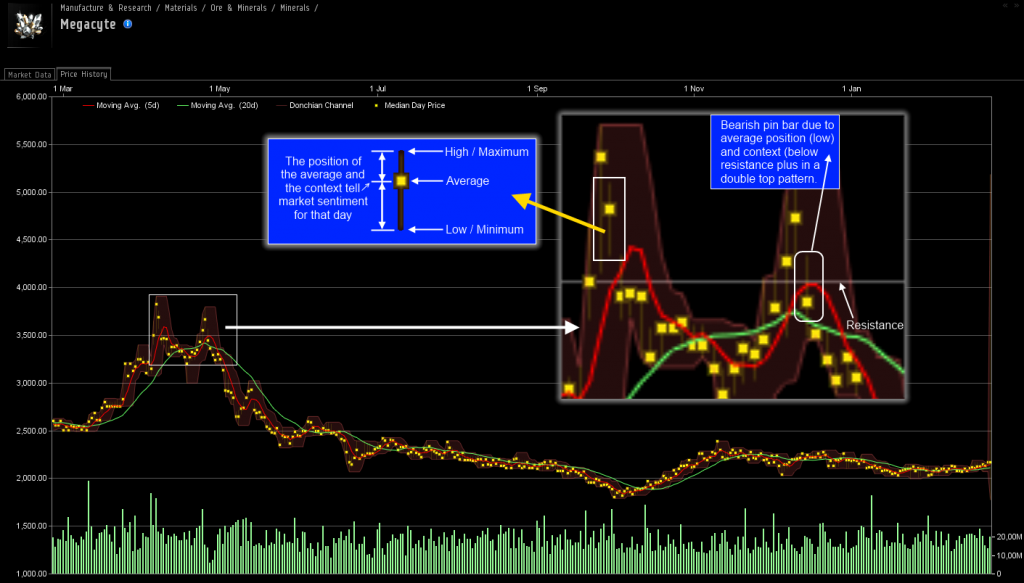

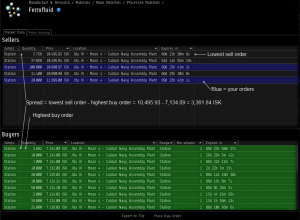

Bid – ask spread: buyers want to buy at the lowest possible price, sellers want to sell at the highest possible price. At the same time, some buyers and sellers either are happy with the price asked by a close counterpart or just give up achieving their goal or have a pressuring need to buy / sell that stock or are just scared by bad news. The exchange (usually through brokers) checks thousands of market orders every second and sees if some of them match. If they do, then a trade happens, and overall stock price rises or drops a bit in the direction of the trade. The exchange may show a so called “orders book” or “market depth view” (in EvE it’s the markets order window) listing a predefined number of the closest orders.

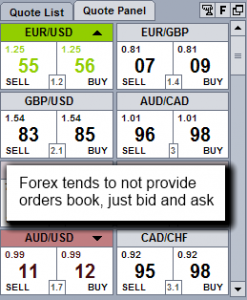

Other markets don’t come with an orders book, they only show the orders closest to the current price: the buy order(s) immediately below it and the sell order(s) immediately above it. Those orders may be selected basing on several criteria, the most used is for “closest orders to current price”. It’s important to know that price only forms when deals are done. The price difference that separates the lowest sell order(s) from the highest buy order(s) is called bid – ask spread or just spread. Spread plays a major part in traders’ profitability and along with the risk of stop loss and broker’s fees is what makes “coin toss” trading unprofitable. Traders must employ expecially crafted trading methods to give them enough of an “edge” to make up for the natural loss deriving by the above listed factors. A ballpark number for traditional trading methods is 65-75%. Any less than that puts long term profitability in jeopardy.

Those orders may be selected basing on several criteria, the most used is for “closest orders to current price”. It’s important to know that price only forms when deals are done. The price difference that separates the lowest sell order(s) from the highest buy order(s) is called bid – ask spread or just spread. Spread plays a major part in traders’ profitability and along with the risk of stop loss and broker’s fees is what makes “coin toss” trading unprofitable. Traders must employ expecially crafted trading methods to give them enough of an “edge” to make up for the natural loss deriving by the above listed factors. A ballpark number for traditional trading methods is 65-75%. Any less than that puts long term profitability in jeopardy.

Comments