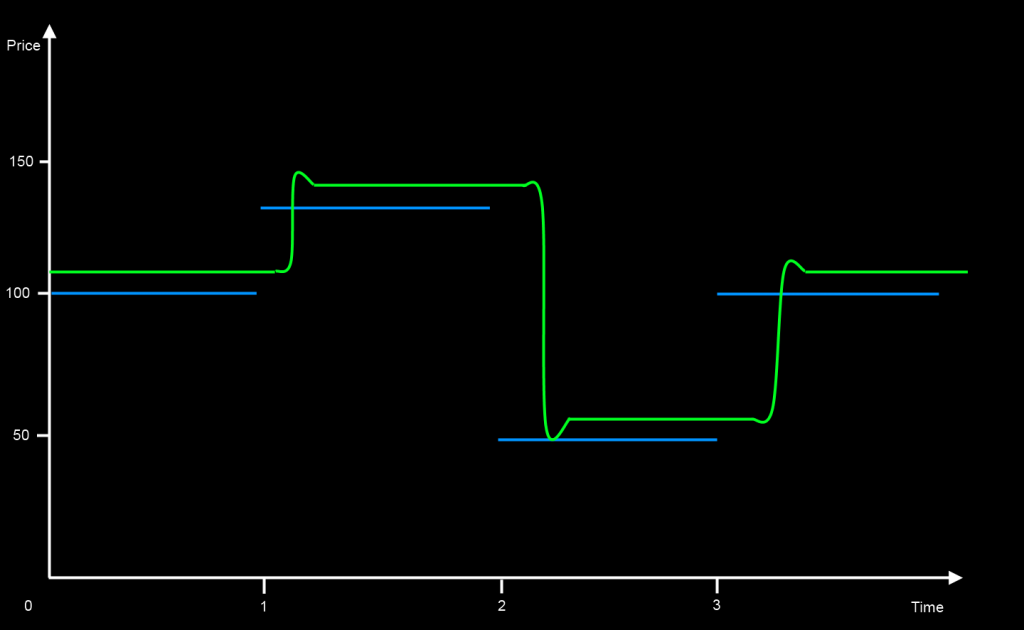

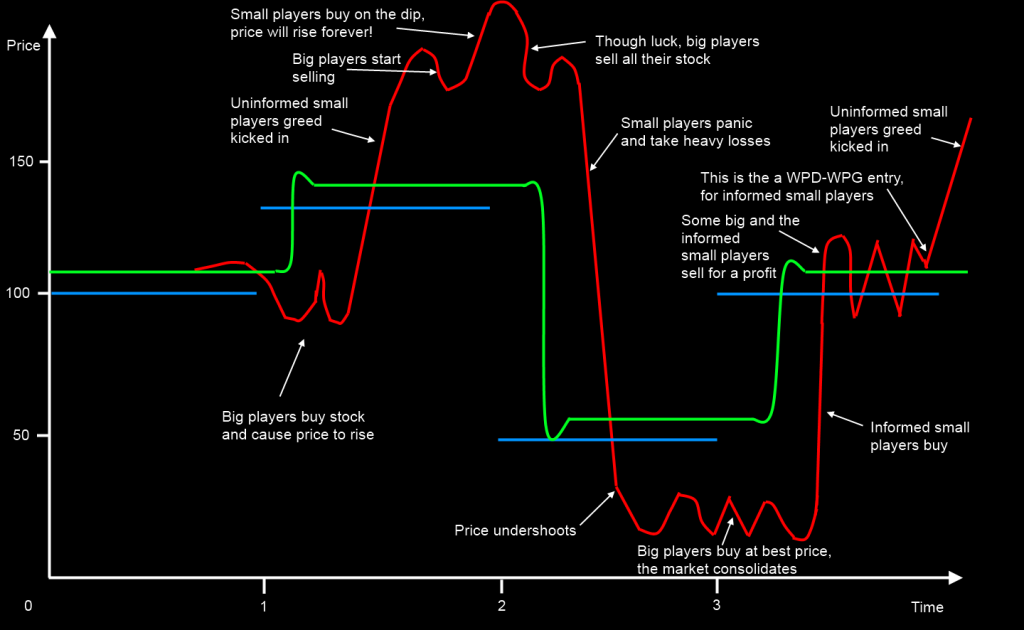

Now, market lag, inertia, fees and overshooting are factored in. They are due to inability to trade the whole stock in a split second by informed large market players, to exchange fees and more.

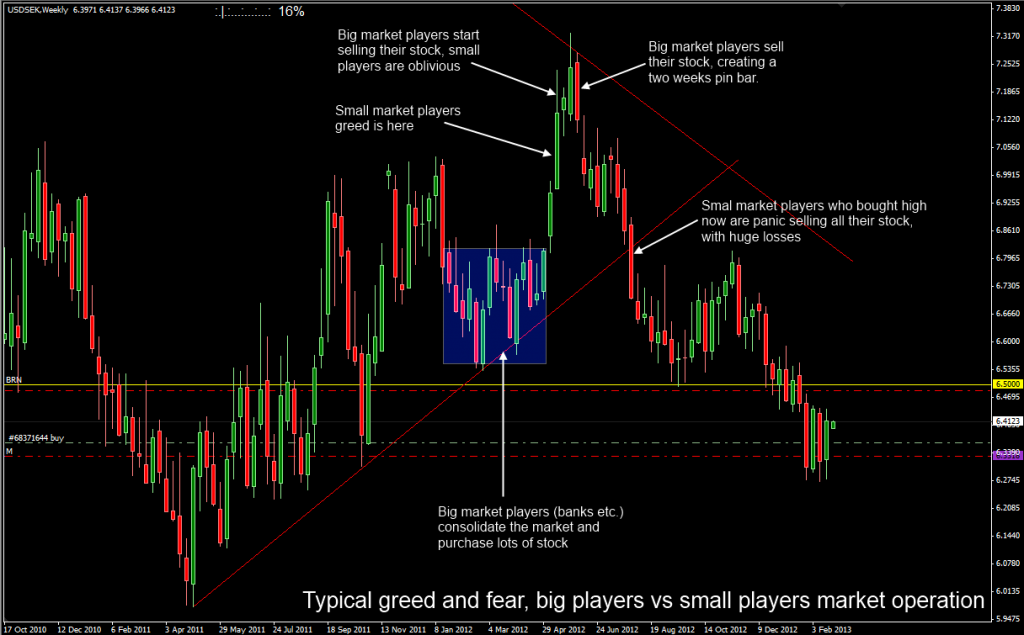

Finally, once speculators and smaller traders are added, their greed and fear, their uninformed projections and the higher inefficiency and cost of their brokers adds all sorts of overshooting, bumping and so on.

- Greed and fear: to a trader these two contrasting feelings are as much important if not more than supply and demand. In fact they downright kill one of the most important trader laws: “cut your losses short and let your profits run”. Greed makes traders see price setups and enter risky trades they should not take. Fear makes traders move stop loss orders for trades going against them, greatly harming their account. Combined greed and fear make traders close their positions very soon to “cash in something quick” or at the first signs of price going against them. Moments later they see price turn around and return going their planned direction. Greed and fear bring in emotions in the markets and cause all sorts of price overshooting, bubbles, panic selling and so on. Using someone else’s greed and fear is one of the most powerful and safe tools in the hands of the practical trader.

- Price inertia, overshooting, lag, requotes, slippage, gaps: these are caused by a myriad of interwined factors and basically make efficient market theories even less useful to model reality.

Go to Index | Prev: Key to the course abbreviations and acronyms | Next: Price

Comments