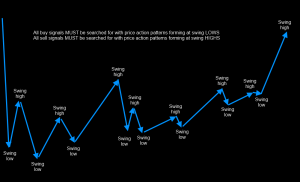

The following other chart shows the pure swings without underlying bars. In order to obey to the second trader commandment (*): “buy low, sell high”, we MUST search for price action (only) at the lows, that is the “valleys” and sell at the tops.

Therefore a fantastic bullish price action bar sitting at the middle of a swing or, worse, at its top, is the worst trade EVER. You WILL be stuck buying high and will panic dump and lose big amounts if you don’t do as I say in these paragraphs.

(*) The first trader commandment is “capital preservation!” (that is, don’t lose your capitals), the third is: “the trend is your friend”.

Let’s get back at the daily chart: price has put a good dozen of potential entries, I picked 8 of them. With respect to the concepts shown above, most of those entries are worthless if not dangerous.

~1~

Let’s analyze the entries one by one:

1) A nice PB (pin bar), too bad it closes below the monthly level. You NEVER buy on a bullish pattern closing right below a price level, only above it. Likewise you must always short sell (in real life markets that allow that) after a pattern closing below a price level.

2) A nice 2D PB (two days pin bar), but it has the same identical issue shown at 1).

3) A not really nice BUOB (we want the second bar to be nicely taller than the first) and it closes below the monthly level as well.

4) A most excellent entry! This is it!

– it closes above the monthly level and in a tangible way,

– the second bar closes well above the first. This gives strength to the pattern,

– of course it’s in trend and concording with the weekly and monthly charts bullish direction,

– it comes after a short swing low. This is fundamental. This is the essence of “buying low, selling high”. The 3 bars before it formed a an higher high swing (that is a “new high”) but we don’t want to buy high yet we want to buy “before it will go high”, that is at a so called “higher low” swing.

– money management will be easy! As you might recall from me having repeated it dozens of times on the EvE forums, the first pin bar target is the high of the previous bar or the first resistance level, whichever comes first (flip all the terms for bearish pin bars). This means that as long as we are with the trend (hence the importance of having monthly, weekly and daily charts all showing the same trend), price will very, very often go exactly at that first target. This is an enormous value, because by doing like I am showing you, you are just stacking the odds in your advantage!

Considering money management is the most important trading operation after finding the right entry, I can’t stress enough about this point.

The specific entry shows an healthy distance between the pin bar body and the previous bar high, by entering there you are good probabilities that price will at least reach that distance and thus bring in the “bootstrap profit” that in real life is needed to remain in the market. In fact, unlike EvE, in real life markets outside stocks, if you enter bad, you WILL have to leave the market and will lose a lot of money. These entries help you get a first “pulse” off the market allowing you to immediately put the trade to a safe status where you will not lose money regardless of what happens next.

So, 4) is our trade. Let’s see the others, just for sake of analyzing why they are bad so you learn the proper selection criteria.

5) Pin bar closes below the monthly level. See 1) and 2).

6) BUOB closes above the monthly level. This is one of those deceiving “pretend good” trades. It indeed works some times, but it has a fatal flaw: the BUOB comes at a swing high. Look the bar before it: it’s bullish. We want the BUOB (or PB or whatever) to come after a bearish bar that forms itself a swing low.

7) Same as 6. This one is easier to see, you may visibly notice this pin bar is “appended” and hanging after a bullish bar.

8) A late entry, this looks almost identical to 7) but it’s not! Surprisingly enough, the chances this trade will end well are much higher than 7). Why? Because this is a bullish pin bar coming after a bearish other pin bar, that is we have our bearish bar before the price action. This setup is decent, yet still far from optimal because:

– it comes so late, usually the earlier you are in the market the better.

– the pin bar tail is small. This means less momentum, slower profits and higher risk.

– the pin bar is not adjacent to / sitting on top of a level or trend line. The market loves to go hit those levels, therefore if you enter on a bar “in the middle of nowhere”, chances are that the market will go hit the levels and will make your stop loss trigger. You will get a stinging loss, just to see price restart and go exactly the direction you predicted. The damage and insult at the same time!

In EvE there’s no stop loss, so you are spared these pains, but I want to prepare you to confront with the butchering real life markets, those that make EvE look like an happy ending Hello Kitty™ adventure in comparison!

– coupled with the previous pin bar, this pin bar forms a 2 days pin bar. Seen as one pattern, then it’s placed after the bullish bar (see 7) and thus provides for a worse entry than 4). Entry 4) is another 2 days pin bar but the bar before the first day bar is bearish, preserving the “enter at swing lows” commandment.

There are other price action bars past this but they suffer from the same shortcomings shown above and come way too late to take good profit from them.

I sincerely hope you’ll spend all the needed time reading and re-reading this analysis, because the concepts explained here are to be learned by memory and become your second nature. Else you stand NO HOPE.

Have a good and profitable day,

Vaerah Vahrokha

Vahrokh Consulting CEO