Consulting

Consulting

Audit report for Tanith YarnDemon business proposal

This is Vaerah Vahrokha’s analysis as of 2012-02-16 19:00 EvE Time.

NEISIN code: CSHNETXBO018.

Official discussion: link to investment prospectus.

Public Audits Record (PAR) for this investment: backlink.

Tools used

jEveAssets

EvE Mentat

Microsoft® Excel™

Blender 3D => LuxRender

Paint.NET => Bolt Bait Pack, DPY Plugins, MadJik Pack, Vandermotten Effects

Forewords about the Audit

Tanith YarnDemon is an high sec trader and capital ships manufacturer. He also builds other assets that look profitable.

In order to expand on his current activity he is starting a collateralized, public bond.

This audit will not cover the general trading activities in depth, it’s mostly focused at skills and production jobs checks and NAV statements.

Generalities

Main character for this proposal is Tanith YarnDemon, along with four other accounts and another associated player, a real life friend of him. Among the various characters, there are skills for manufacturing a diverse basket if items including capital ships, high end faction ships of all sorts, mineral compression items, several level IV skills for trading, contracting, mining, refining, hauling with industrials and freighters, L4 missioning, incursions and PvPing (but he stopped such activity in 2009-2010).

Tanith YarnDemon, is a March 2008 character with 68.7M SP.

Investigation through about a total of 800 posts seem consistent with the character not being purchased. Post history is ok, except for some old auctions the Investee self bumped by using some of his alts. Killboard is ok, save an empty CNR loss, bought in low sec at rebate price but resulted into a log in trap.

Statement of ability to deliver: the contracts API has been manually queried to find out whether the claimed products were produced and in a sufficient volume. There have been found more than 60 capital ships contracted in the last month, for about 62.404B.

Statement of past activity: the jobs API records report production for many kinds of items including the stated capital ships.

Involvement in other business

None at the moment.

Business Plan Analysis

The Investee posted a draft / discussion of the bond here.

He also disclosed his manufacturing and trading strategy to the Auditor.

The business plan is about raising funds to be able and provide enough input materials to a production chain and sell the finished products.

The Investee is already in the proposed production and market niche, his logistics have shown no relevant losses.

The Investee even in a worst case scenario is also active into general trading and has a number of unused fitted exhumers laying around.

Due to the relative slowness in capital ships production and the possible mineral prices drop in the coming months, it’s possible the plan will lose some of its profitability over time. This could force the Investee into selling products aligned with current mineral prices, while he had to purchase those minerals when their price was higher.

Feasibility statement: the business plan looks viable, especially after the lowering of the offered interest rate.

Collateral and exit strategy

The Investee tasked Chribba to hold / lock BPOs as collateral covering the full bond principal.

No exit strategy has been discussed but his associate could be able to honor the bond in case the Investee meets unforeseen issues at continuing the production.

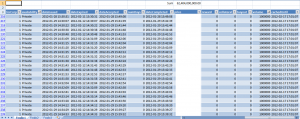

Net Asset Value and other balance considerations

The estimated net worth of all liabilities, solid & liquid assets is about 279.441B ISK. These include the 50B worth of BPOs now held by Chribba.

Market transactions are made by the Investee character.

Assets across all of the characters and corporations are estimated to be worth 188.792B.

Important notice: the reported values are lower than the real amounts, because certain assets in certain conditions are not reported by the API.

There are an additional more than 60B worth in minerals currently being used. The NAV for the Chribba’s managed production corporation is worth about 110-120B (minerals plus components plus BPOs).

Assets and balance

| 1">audit-record" style="text-align: left;" colspan="3">Balance | ||

|---|---|---|

| Wallet balance: | 77.700 | B |

| Market sell-orders: | 11.928 | B |

| Market escrow: | 1.021 | B |

| Contracts: | 0.000 | B |

| Investments / receivable: | 0.000 | B |

| Liabilities / payable: | (0.000) | B |

| Total: | 90.649 | B |

| 1">audit-record" style="text-align: left;" colspan="3">Assets | ||

|---|---|---|

| POS: | 3.492 | B |

| Fleet / ships (unfitted): | 12.916 | B |

| Modules: | 82.210 | B |

| Misc. solid assets; minerals, salvage, ice and trade goods etc.: | 5.597 | B |

| Blueprint copies and originals: | 61.646 | B |

Other | ||

| Accessories (includes PLEXes): | 5.203 | B |

| Charges: | 3.546 | B |

| Commodities: | 4.795 | B |

| Drones: | 1.961 | B |

| Ordered assets under construction: | 0.000 | B |

| Planetary items or resources: | 1.113 | B |

| Ship components: | 0.005 | B |

| General or classified items: | 6.308 | B |

| Total: | 188.792 | B |

Estimated grand total: 279.441 Billion ISK

The above evaluations were made by using The Forge prices as reference.

Current assets

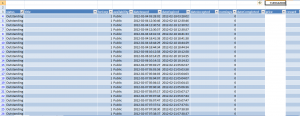

The Investee heavily deals in contracts. Since the general EvE Investor might be not accustomed at complex balance sheets, the Auditor chose to keep the current assets off the NAV. There is a total of 7,169,342,000 ISK in current assets. When sold, those would add to the current wallet balance.

Another reason to keep them separate is the current lack of reliable contracts API software, the whole process has been completely performed by hand and Excel, since tools like API Jacknife failed to return a correct and full dataset.

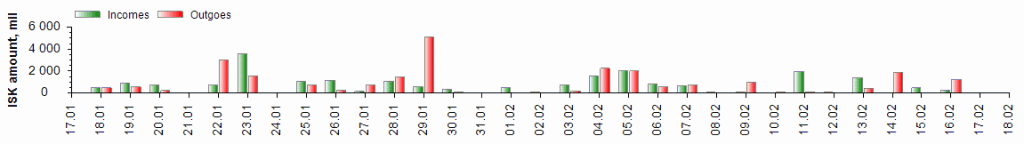

Markets analysis

This is not a full market analysis but just a proof that the Investee also deals in other markets. The balance looks negative but this because it includes all the purchases but none of the finished products contracts sales.

Last month income: 21.15B.

Last month expenses: 24.4B

Total month balance: -3.25B

Positives

The Investee has the character skills to confirm his claims.

The Investee net worth is vastly more than the requested capital, the Investee is comfortable dealing with the involved amounts.

The Investee has proved the blueprints being original.

The Investee accepted an audit, had a prior discussion and took time to share his final prospectus and have some points checked.

The Investee accepted a long conversation to bring many factors in light.

Some PvP past is always a boon when dealing with prolonged operations that could be wardecced or whatever.

Low interest rate makes for an easier investment profitability.

Investment is fully collateralized.

Negatives

Supply chain might be disrupted and tangible losses could happen due to the location of the production.

Part of the Investee production happens in low security, this is always a risk factor, whatever the safety measures and experience involved.

Mineral prices might drop and eat into the investment profitability. The Investee could be forced selling ships whose minerals were more expensive than at the time of sale.

Conclusions

Due to the full collateral, possible RL associate being able to help, multiple availability of records, and Investee past ability both to deliver and form a functional supply chain, the Auditor classifies this investment as moderate risk.

Please notice how “moderate risk” does not mean “safe”. There might be loss of profitability over time, supply chain disruption, real life issues involving the Investee or Chribba.

The Investee seems competent (skills wise and player wise) enough to deliver on his statements and has records. His business is in a growth phase, his API records show he may operated as he stated.

Basically, the Investee looks like with the ability to successfully honor the bond. Notice how an audit can only evaluate the ability or potential of an Investee to succesfully honor a bond / IPO.

The Auditor suggests perspective Investors NOT to invest their full capital on this venture but to offer what they could eventually afford to lose.

Disclaimers

Due to stringent EvE API limitations, although the information provided to you on this document is obtained or compiled from sources believed to be reliable, Vahrokh Consulting cannot and does not guarantee the accuracy, validity, timeliness, or completeness of any information or data made available to you for any particular purpose.

This Auditor is actively and passionately against any breach of privacy, in particular regarding in game mail API access. Therefore no information will ever be gathered and no audit will ever be released that will contain any element found by eavesdropping someone else’s private communications.

Neither the information nor any opinion contained in this document constitutes a solicitation or offer by Vahrokh Consulting or its affiliates to buy or sell any securities, assets or services.